Facebook wants to use its influence for a world-changing innovation – a global digital currency. The online network assures that it will not have access to users’ financial data.

Mark Zuckerberg wants to change the financial world: Facebook invented a new global currency. The digital money with the name Libra is similar to the Bitcoin on the so-called blockchain technology, but should do without price fluctuations. Facebook will have no access to the transaction data, assured the responsible for the project Facebook manager David Marcus.

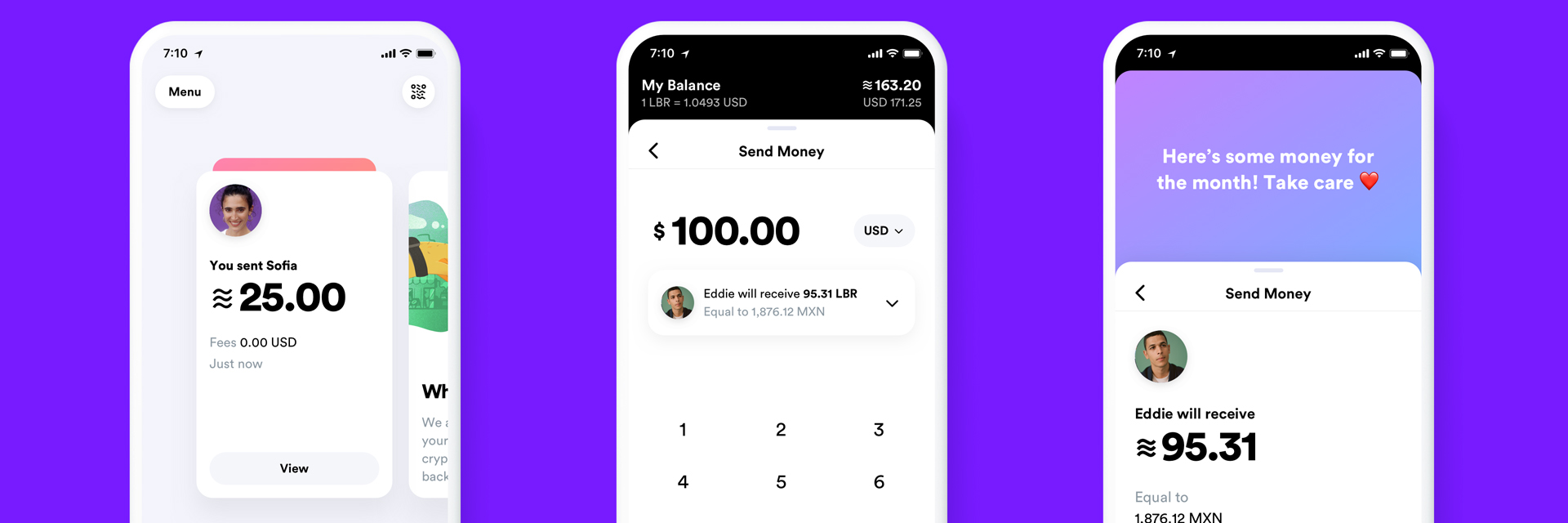

In the beginning, the digital money should be used mainly for transfers between different currencies, said Marcus. This would allow Libra to compete with services such as Western Union or Moneygram, which charge high fees for international transfers. However, the vision is to make Libra a fully-fledged means of payment for all situations.

Libra: Payments via Facebook and WhatsApp Messenger.

For consumers, it should be easy to exchange money between Libra and other currencies and to make transactions with it. So you should be able to execute Libra transfers, for example, directly in Facebook’s chat services WhatsApp and Messenger. With a link to the bank account Libra should also be able to be exchanged directly on the smartphone in other currencies.

To reach the big goal of a digital full currency, Facebook has forged an alliance, the Libra Association. This alliance and not Facebook should manage the digital money. Among the currently 28 members are the financial service providers Visa, Mastercard, Paypal and Stripe – which should facilitate the integration into payment systems. Also on board are Vodafone and Ebay, the travel booking platform Booking.com as well as the music streaming service Spotify and the carpool brokers Uber and Lyft. For the Libra launch in 2020, he hopes to have more than 100 members, said Marcus. Facebook will not have a special role in the organisation.

Libra should avoid price fluctuations.

Previous Blockchain currencies like Bitcoin are infamous for their massive price swings – that’s something Facebook desperately wanted to avoid at Libra. Therefore, Libra will be fully covered by a reserve fund with various currencies such as the dollar, the euro and the yen. The Libra Association will also determine how currencies and securities such as bonds are held in reserve to maintain a stable price. Also unlike Bitcoin, Libra is not created by the users themselves, but must be purchased from members of the alliance or on trading platforms.

Facebook leaves no doubt that in the end Libra will become a global currency, with which you can buy anything and everywhere just as with today’s money – whether online or in a store. At the same time, Marcus thinks every new currency will take a lot of time to grow as big as an existing national currency of a big economy.

One reason for this is that in the developed world the payment channels are already well established with today’s possibilities. Marcus claimed that in at least the next ten years, we will all get our salaries and pay taxes in the currency of the countries we live in. At the same time there are also countries with high inflation and poorly developed banking systems – and a digital currency such as Libra could play a much bigger role here “because it can provide a solution to many problems”. In China, Libra will not be available.

Image Source: Calibra

Users can act under the pseudonyms in the Libra system and have multiple accesses. The usual regulation – for example, measures against money laundering – will take effect at the wallet level, said Marcus. For companies that want to become founding members of the Libra Alliance, a hurdle has been set: they must have a market value of at least one billion dollars or more than 20 million customers. Members must invest at least ten million US dollars.

Libra works differently than Bitcoin.

The best-known blockchain currency Bitcoin is organised differently: Here, the units are generated by mathematical calculations on users’ computers – “scratched”, as it is called in the jargon. The total number of Bitcoin that can be produced is limited. And the calculations for it are becoming more complex. In the meantime, high-performance computers are needed to create Bitcoin, which is why commercial mining mines are currently the main target. This increases the energy consumption and the scarce supply can cause price jumps. At the peak, a bitcoin cost $ 20,000 at the end of 2016 – then the collapse followed. Meanwhile, thanks to rumours about Facebook’s plans, Bitcoin is back to the $ 9,000 mark.

Image: Wikicommons

In a blockchain, encrypted data about transactions are strung together and stored in different locations. A comparison would make any changes noticeable, which provides security. Facebook has succeeded in his system to solve known problems of technology such as slowness. At Libra, it does not come to the high energy consumption as in Bitcoin. Facebook also developed a new programming language called Move for the system.

Marcus, before joining Facebook, was head of Paypal. In the online network, he was initially responsible for the chat service Messenger until Zuckerberg entrusted him with the blockchain project.

Banner Image: Facebook.